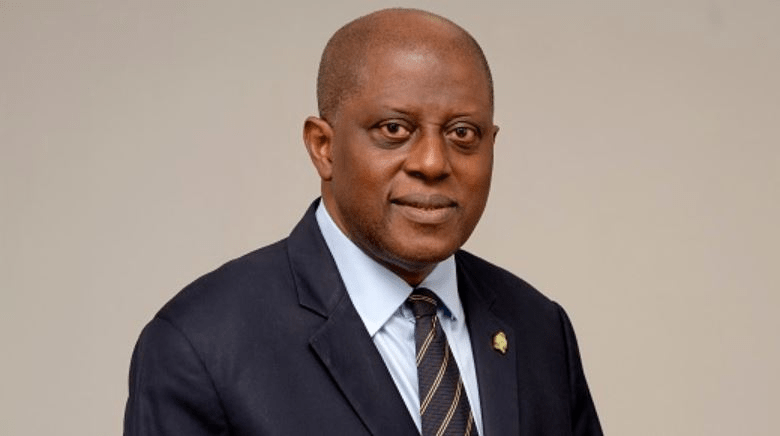

The spending of Nigerians on foreign education, medical tourism and personal travels gulped over $98bn in 10 years, according to the Central Bank Governor, Olayemi Cardoso, told members of House of Representatives on Tuesday.

He made the disclosure while responding to an inquiry by the lawmakers on the factors behind the historic depreciation of the naira.

The lawmakers had invited Cardoso and other economic managers following last week’s plunge of the naira from about 900/dollar to over 1,400/dollar at the official market.

According to Cardoso, the foreign exchange market is facing increased demand pressures, thereby triggering a continuous decline in the value of the naira.

The CBN governor said factors responsible for the continous depreciation of the Naira include speculative forex demand, inadequate forex due to low remittance of crude oil earnings to the CBN, increased capital outflows, and excess liquidity from fiscal activities.

To address exchange rate volatility, he said a comprehensive strategy had been initiated to enhance liquidity in the FX markets.

This includes unifying FX market segments, clearing outstanding FX obligations, introducing new operational mechanisms for Bureau De Change operators, enforcing the Net Open Position limit for commercial banks, and adjusting the remunerable Standing Deposit Facility cap.

He revealed that between 201O and 2020, foreign education expenses amounted to a substantial $28.65bn, as per the CBN’S publicly available Balance of Payments Statistics.

Similarly, medical treatment abroad incurred around $11.01bn in costs during the same period. Within the same period, Personal Travel Allowances accounted for a total of $58.7bn.

Cumulatively, Nigerians spent about $98bn on foreign trips, medical tourism and overseas education, a figure the CBN governor said was more than the total foreign exchange reserves of the central bank.

Further compounding the situation, according to Cardoso has been the consistent decline in Nigeria’s export earnings against the backdrop of increasing imports.

Throwing more light, Cardoso pointed out that Nigeria’s annual imports, which require dollars for payment, amounted to $16.65bn in 1980.

By 2014, the annual imports had significantly surged to $67.05bn, although it gradually decreased to $54.71bn as of last year.

Also, food imports escalated from $2.63bn in 1980 to $14.84bn in 2019.

The CBN Governor said, “In 1980, our import expenditure stood at $16.65bn, while our exports amounted to $25.97bn, resulting in a surplus of $9.32bn. Thus, during that year, we managed to fulfil the demand for dollars from our existing supply and still had over $9bn in surplus. In such a situation, the exchange rate (the value of the US Dollar) would not increase because, similar to any commodity, its supply surpassed its demand.”

Also contributing to the free fall of the naira, per the apex bank, has been a significant decline in Nigeria’s oil revenues, he said.

“Moreover, from 2003 to 2013, we experienced a surplus of $331.73bn in the economy, with oil exports alone contributing over $798bn. This surplus of dollars would typically stabilize the exchange rate, leading to a “strong” naira.

“ Regrettably, over the past 12 years, oil exports, constituting over 90 per cent of our foreign exchange earnings, have declined from $93.89bn in 2011 to US$31.4bn in 2020,” Cardoso added, while noting that monetary policy actions were sometimes inhibited by transmission lags.

“It also seems that the task of stabilising the exchange rate, while an official mandate of the CBN, would necessitate efforts beyond the bank itself and indeed to an attitudinal change of all our citizens,” he added.

Cardoso expressed optimism that that the policy measures implemented by the apex bank would permeate the economy in the short to medium-term.

“Inflation pressures may persist, albeit temporarily, but are expected to moderate significantly by Q4 2024. Exchange rate pressures are also expected to reduce with the smooth functioning of the foreign exchange market,” he said.

Foreign products

According to the CBN governor, one of the primary reasons the naira has continued to take a beating on the international stage has been Nigerians’ appetite for all things foreign.

The CBN governor explained that the exchange rate is determined by the dynamics of supply and demand for a product or service.

In essence, similar to the pricing of cows or cars, the value of the US dollar in Nigeria is determined by the balance of US Dollars entering the country and the demand for US Dollars among Nigerians.

Cardoso’s argument hinged on the fact that a major reason the naira had become weakened over the years was the growing distaste for locally manufactured goods.

He said, “In 1980, more than 75 per cent of the vehicles used in Nigería were domestically produced by companies like Volkswagen in Lagos, Peugeot in Kaduna, and others.

“Presently, over 99 per cent of the cars driven are imported, necessitating dollar payments. Similarly, in 1980, the majority of the clothing worn was sourced from Nigerian textile mills in Funtua, Asaba, Kano, Lagos, and various other towns and cities. Today, nearly all the clothing worn is made from imported fabrics. Given the substantial demand for education, healthcare, professional services, personal travel, and similar needs, the exchange rate is bound to face ongoing pressure.”